Welcome to your

Your Cash Flow Simulator

The simulator is based upon the Cash Flow Code:

Using the 6 keys that control cash flow

As a business owner, you want the hard work you put into your company to give you the biggest possible return. After all, who would want to increase profits by only £10,000.00 when, with the same amount of effort, you could increase them by £40,000.00?

At the same time, you do not want to work hard to increase your profits, only to find you actually have no money in the bank!

The Cash Flow Simulator enables you to forecast your profit and cash flow for the next 12 months based upon simulating any changes you may make to your company. This allows you to test what will make the biggest impact to your business before actually taking action and enables you to plan strategically for your company’s development and growth.

To begin using the simulator, you will need to input the seven key numbers achieved in the previous 12 months. These numbers can be found in your company’s Balance Sheet, Profit & Loss and Cash Flow Statements, which are:

To begin using the simulator, you will need to input the seven key numbers achieved in the previous 12 months. These numbers can be found in your company’s Balance Sheet, Profit & Loss and Cash Flow Statements, which are:

- Sales

- Cost of Sales

- Expenses

- Accounts Receivable

- Accounts Payable

- Inventory / Stock

- Cash in the bank at the start of the period

The Simulator is divided into two sections:

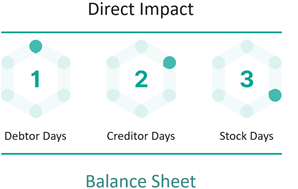

Balance Sheet Account:

The top 3 keys that directly affect cash flow can be found on your company’s Balance Sheet.

Accounts Receivable: This will be calculated in terms of Debtor Days. A Debtor Day is the length of time it takes your customers to pay you from the date you issue an invoice. You will want this number to be as small as possible.

Accounts Payable: This will be calculated in terms of Creditor Days. A Creditor Day is the length of time it takes you to pay your supplier from the date you receive their invoice. You will want this number to be as high as possible BUT a word of warning here… You must never be a bad customer to your supplier. The best way of increasing the length of time to pay your suppliers is to call them and renegotiate credit terms.

Inventory / Stock: This will be calculated in terms of Stock Days. Stock Days are the amount of days it will take you to sell all your stock. You will want this number to be as small as possible, which means the stock you have is fast moving and there is no dead money sitting on your shelves.

If your business is more of a service based business you may not have any stock. That is absolutely fine; all you need to do is to leave that field blank.

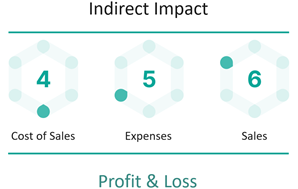

Profit & Loss Account:

When the Simulator has been loaded with your company’s previous 12 months’ data, you will be able to see how any changes to your Sales will affect your profits and, more importantly, cash flow. The Cash Flow Simulator allows you the opportunity to see if you can fine-tune your business to gain the maximum return for an increase in revenue.

The areas in your Profit & Loss Account that will dramatically affect profits will be your Cost of Sales and Expenses. If any of these figures can be reduced, even by 1%, this will have a big impact on how well your business performs.

Simulator results:

The results of any changes you make to Sales, Cost of Sales, Expenses, Debtor Days, Creditor Days and Stock Days will be shown on the right-hand side of the Cash Flow Simulator, in both table and graph form.

The Cash Flow Simulator allows you to play with these numbers and shows you the result – be it positive or negative – of what will happen if you were to implement them into your business. It gives you a chance to see which changes will be most effective in increasing your cash flow and ultimately, how efficient you can make your business.

The saying: “Turnover is vanity, Profit is sanity BUT Cash is REALITY” is very true. Therefore we recommend the order in which you make these changes is firstly to your Balance Sheet then to your Profit & Loss Account. Fix any cash leaks first then look to drive the business forward.